Why Is Margin Of Safety Book So Expensive

This 1991 book is an investing classic so much so that it sells for 780 on the secondary market. A margin of safety is necessary because valuation is an imprecise art the future is unpredictable and investors are human and make mistakes.

Osha Regulations For Restaurants Workplace Safety Tips Osha Regulators

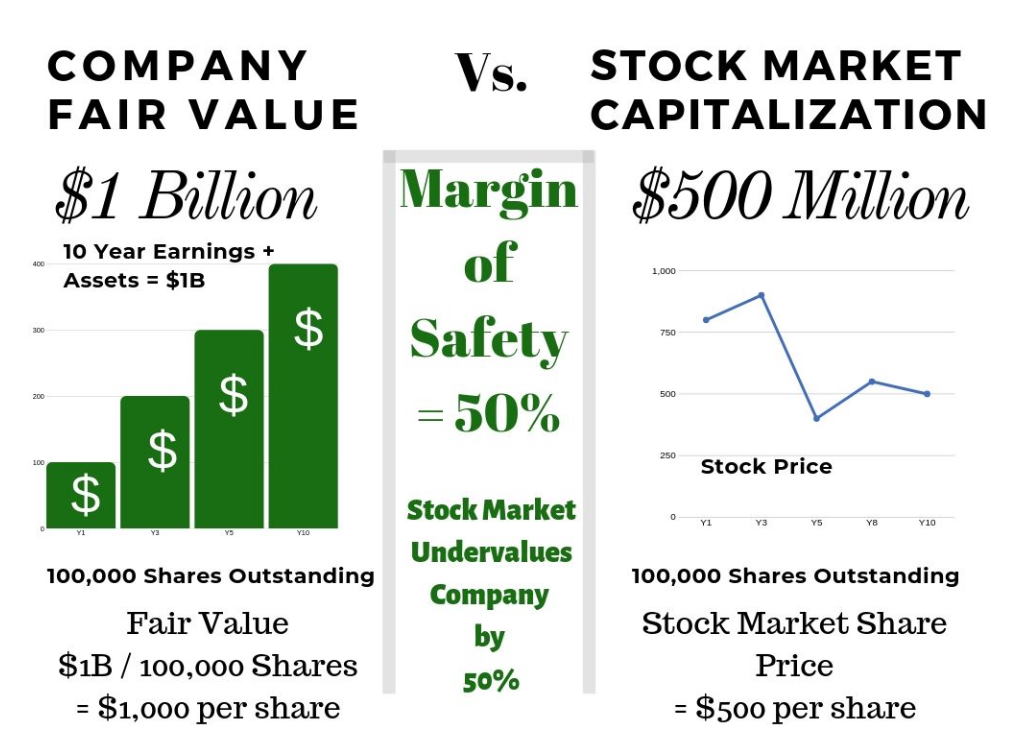

The strict value investors may have a MOS of over 50 to minimize the downside risk.

Why is margin of safety book so expensive. Margin of Safety summary. My notes are informal and often contain quotes from the book as well as my own thoughts. He also continuously promotes the philosophy of maintaining a margin of safety.

Margin of Safety in Accounting. The key insight for most value investors is the all investments must have an inherent margin of safety. It is sometimes said to be the most important book available on value investing after The Intelligent Investor by Benjamin Graham.

This hardback book is 249 pages long and is published by HarperCollins. You have to have both. He remains a valu.

In his 2012 year end letter Klarman writes that he endeavored to make the book timeless with a focus on how to think about investing but that there are categories of opportunity today that could not have been contemplated then. Its pages hold his unique views on the stock market and investing techniques while offering a more humanized version of how to properly invest. I never came across that one but I know someone who did get a copy and.

But there are some. Here the difference in the calculated intrinsic amount and your final purchase price is your margin of safety. Diversify adequately hedge when appropriate and invest with a margin of safety.

The first one that comes to mind is Margin of Safety a book on investing written by a billionaire. Its a book about managing risk. Seth Klarmans Margin of Safety is a rare and elusive book that sells for a huge premium over its IPO original price.

The margin of safety. And its namesake is the key to it all. Jul 22 2012 - 237pm.

Klarman on why he wrote the book. To calculate the margin of safety subtract the current breakeven point from sales and divide by sales. The ideal margin of safety depends on the risk tolerance of an investor.

You could have the rarest item in. Klarman quickly stopped production of his Margin of Safety book to make a limited print making it a rare and expensive find. On the other hand aggressive investors may choose a comfortable MOS of 10.

Seth Klarman is well known for keeping substantial amount of cash 50 in. Risk-averse Value Investing Strategies for the Thoughtful Investor is a 1991 book written by American investor Seth Klarman manager of the Baupost Group hedge fundThe book discusses Klarmans views about value investing temperance valuation portfolio management among other topicsKlarman draws from the earlier investment book The Intelligent Investor chapter 20. A rare and expensive investment book tearing up the Amazon Kindle charts is actually an illegal copy.

This 1991 book is an investing classic so much so that it sells for 780 on the secondary market. You probably wont find a hard copy as it is out of print and selling 2000 USD per copy. As a financial metric the margin of safety is equal to the difference between current or forecasted sales and sales at the break-even point.

Quite simply its in very limited supply and has not been reissued. Klarman follows a value investing philosophy that originated with Ben Graham. Certified Investment Banking Professional - 3rd.

Supply and DEMAND always drive price. The Margin of Safety by Seth Klarman covers a broad spectrum from providing sound education on the psychology of investing as well as developing the quantitative and qualitative aspects of value investing. There arent a lot of books published in the last 40 years or so that are worth hundreds of dollars.

This is my book summary of Margin of Safety by Seth Klarman. His 1991 work Margin of Safety. There are only a few things investors can do to counteract risk.

The opposite situation may also arise where the margin of safety is so large that a business is well-protected from sales variations. Books that are legitimately expensive on Amazon. It is precisely because we do not and cannot know all the risks.

Not so for the sole book written by hedge fund manager Seth Klarman. Surprisingly it ranks 23 in the category of Books Business Investing Investing Bonds. Margin of safety book free pdf margin of safety pdf downloads margin of safety scanned copy why is margin of safety so expensive seth klarman margin of safety ebook.

According to Klarman it sold 5000 copies at first but it died out basically wasnt a popular book back then yea can you imagine that then he just didnt care to re-publish it when it got more popular later. The key insight for most value investors is the all investments must have an inherent margin of safety. Used copies of his investing book Margin of Safety still sell for nearly 500 online.

You probably dont want to buy the book as a gift for someone you would hate to find out it ended. Risk-Averse Value Investing Strategies for the Thoughtful Investor. A minimal margin of safety might trigger action to reduce expenses.

Nonetheless excellent book which discuss the essence of Value investment.

Indian Stock Market Questionable Margin Of Safety Stock Market Marketing Chart

Formatting Tips Lg Jpg 900 600 Save The Date Invitations Print Making Print

Should You Buy Health Insurance Buy Health Insurance Health Insurance Humor Health Insurance Quote

Tips You Must Know To Start Selling Cakes From Home Home Bakery Business Bakery Business Plan Selling Food From Home

Ev Chargers Market To Grow With A High Cagr 2020 2025 Electric Vehicle Charging Station Electric Vehicle Charging Electric Cars

To Increase Sales And Ultimately Profits Cake Manufacturers Are Using Catchy Slogans Slogans Help Them In Sp Cake Slogans Cake Shop Names Cake Business Names

Ads B Technology Is The Go To Method Of Ensuring Safe Utilization Of Airspace Air Traffic Control Uav Awareness

Margin Of Safety Buffett Graham S Magic Formula Explained

Margin Of Safety Risk Averse Value Investing Strategies For The Thoughtful Investor By Seth A Klarman

4 Steps To Build The Best Munger Buffett Stock Screener Stock Screener Stock Portfolio Investing

Margin Of Safety Risk Averse Value Investing Strategies For The Thoughtful Investor By Seth A Klarman

This Is The World S Biggest Container Ship It Can Hold 39 000 Cars Cargo Shipping Tanker Ship Cruise Ship

Margin Of Safety Risk Averse Value Investing Strategies For The Thoughtful Investor By Seth A Klarman

Posting Komentar untuk "Why Is Margin Of Safety Book So Expensive"