How To Figure Out Margin Of Safety

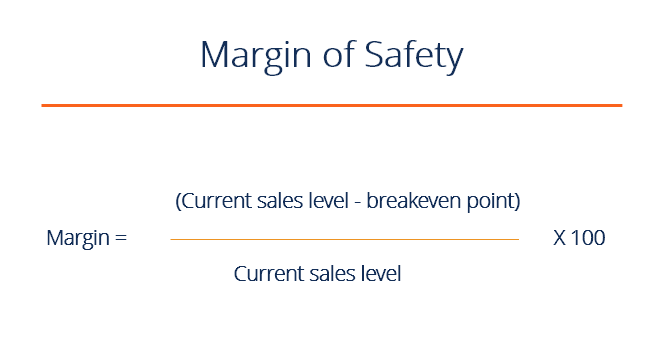

The formula for determining the margin of safety as a percentage is as follows. To calculate the margin of safety subtract the current breakeven point from sales and.

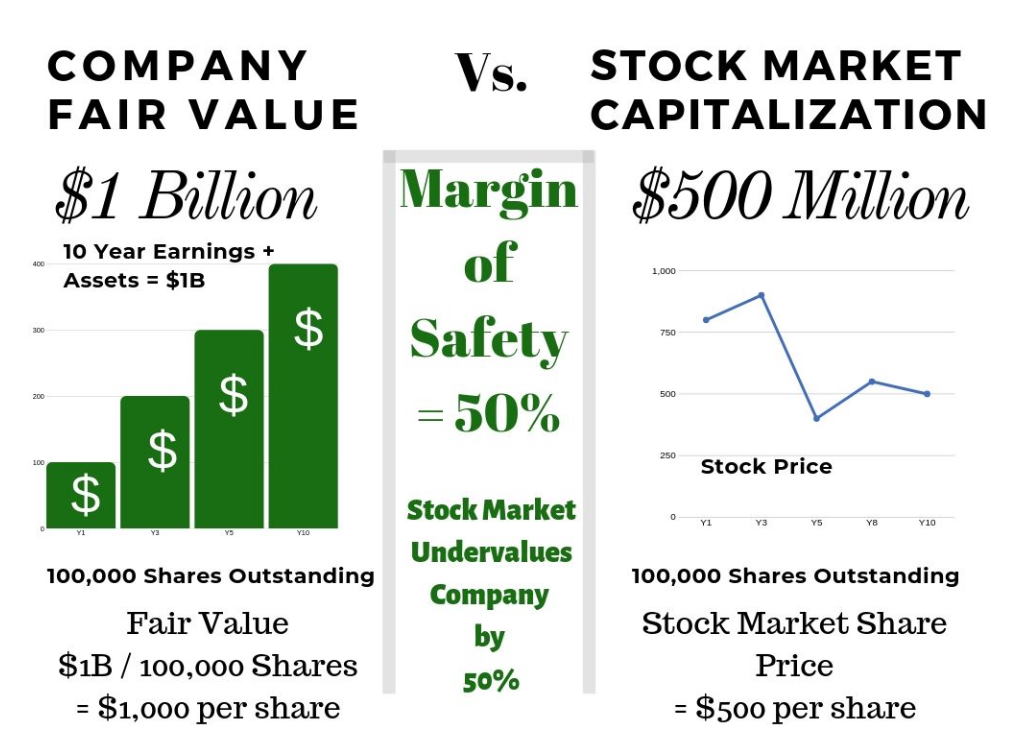

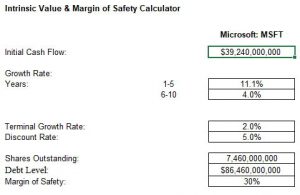

If the total value of all shares of a company is 30 less than the intrinsic value of that company then the margin of safety would be 30.

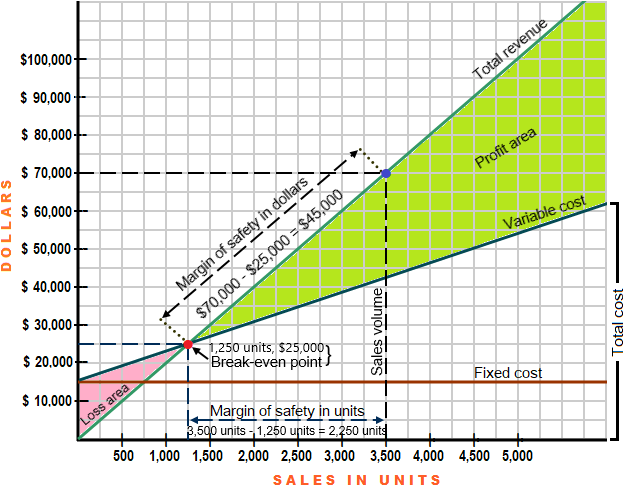

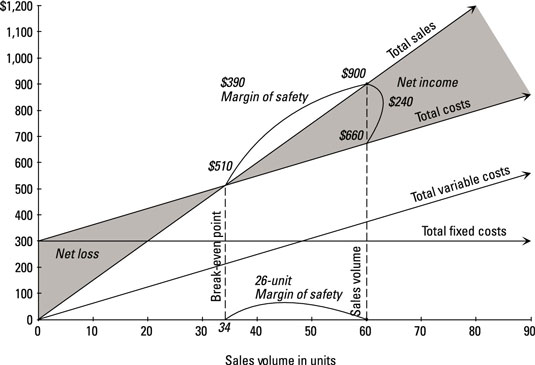

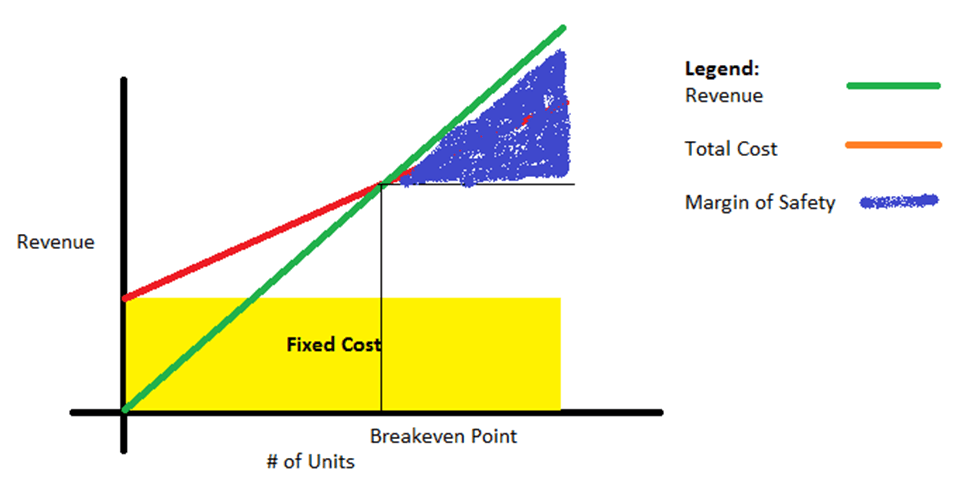

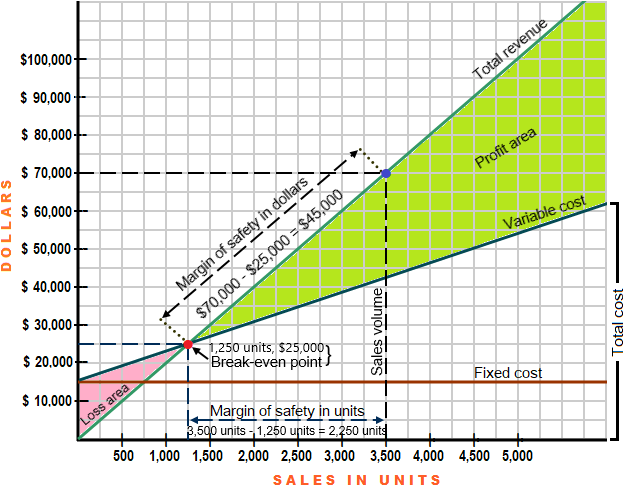

How to figure out margin of safety. Is to simply deduct the break-even amount from the targeted or actual sales revenue. Subtract this decimal from 1. This formula shows the total number of sales above the breakeven point.

Divide 1 by the product of the subtraction. Budgeted sales may be used instead of actual sales to measure the degree of risk of budgeted figures. The margin of safety of an investment serves different purposes to the active investor.

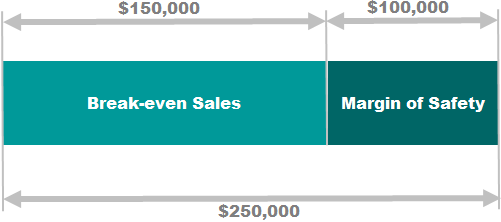

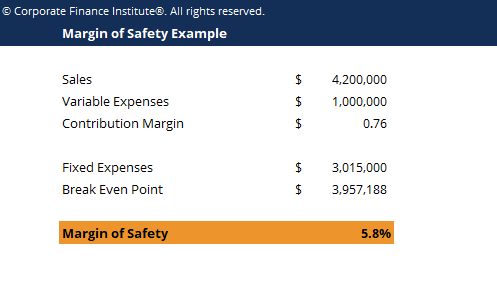

For example a business has a BEP of 100 products and has made 150 sales. The higher the margin of safety the more the company can withstand fluctuations in sales. In accounting the margin of safety is calculated by subtracting the break-even point amount from the actual or budgeted sales and then dividing by sales.

Formula to calculate margin of safety. The margin of safety formula is calculated by subtracting the break-even sales from the budgeted or projected sales. Turn your margin into a decimal by dividing the percentage by 100.

What is the Margin of Safety Formula. Deep Value Investing refers to buying stock in seriously undervalued businesses. Margin of safety actual sales break-even sales.

The intrinsic value is calculated based on the 10 year discounted cash flow DCF. Subtract 1 from product of the previous step. Currentestimated sales and break-even point.

The result is expressed as a percentage. Calculate the contribution margin. The size of the margin of safety will vary based on investor preference and the type of investing that she or he does.

In other words if you calculate that a building company or timber rights for example are worth 1000000 and you pay 600000 your margin of safety is 400000 1000000 intrinsic value 600000 purchase price 400000. Calculating the intrinsic value. The formula for margin of safety requires two variables.

The Margin of Safety for stocks is a percentage estimate of how discounted a stocks price is compared to the estimated 10 years of future discounted cash flow. It is used to measure drug safety in pharma industry. The most commonly used method for value investors to determine the fair value of a stock is the Discounted Cash Flow Analysis DCF.

A minimal margin of safety might trigger action to reduce expenses. Margin of Safety MOS is the ratio of the lethal dose to 1 of population to the effective dose to 99 of the population LD1ED99. Graham borrowed the margin of safety concept for his value investing strategy from the engineering field.

The margin of safety is a ratio measuring the gap between sales and break-even point or the difference between market value and intrinsic value. Margin of Safety Current Sales Level Breakeven Point Current Sales Level x 100. How to Calculate the Margin of Safety Step 01.

The margin of safety is calculated as follows. If a companys intrinsic value 10-year discounted cash flow shares is 30 lower than the current stock price it has a margin of safety of 30. Calculate the break-even point in dollar or unit terms.

The opposite situation may also arise where the margin of safety is so large that a business is well-protected from sales variations. In other words the total number of sales dollars that can be lost before the company loses money. Margin of safety percentage Projected sales volume - Breakeven sales Projected sales 100.

The goal is to find significant mismatches between the current stock prices and the intrinsic value of those stocks. Margin of Safety is a value investing principle popularised by Seth Klarman and Warren Buffett. Investors consider margin of safety to be the difference between intrinsic value and current market price.

Margin Of Safety Formula Guide To Performing Breakeven Analysis

Margin Of Safety Analysis Double Entry Bookkeeping

Margin Of Safety Definition Formula Calculation With Example Efm

Calculate And Interpret A Company S Margin Of Safety And Operating Leverage Principles Of Accounting Volume 2 Managerial Accounting

Margin Of Safety Ratio Definition Explanation Formula And Examples Accounting For Management

Margin Of Safety Definition Explanation Use And Formula Solved Example

Margin Of Safety Definition Explanation Use And Formula Solved Example

Https Www Osti Gov Servlets Purl 1134068

Margin Of Safety Formula Ratio Percentage Definition

Margin Of Safety Buffett Graham S Magic Formula Explained

Margin Of Safety Definition Explanation Use And Formula Solved Example

/content-assets/8115009c2be14d078c62e33dce6056c5.png)

What Is Margin Of Safety And Its Importance

Margin Of Safety Formula Guide To Performing Breakeven Analysis

Managerial Accounting How To Determine Margin Of Safety Dummies

Margin Of Safety Definition Formula Calculation With Example Efm

Angle Of Incidence Break Even Analysis Margin Of Safety Bba Mantra

Margin Of Safety Formula Guide To Performing Breakeven Analysis

Margin Of Safety Buffett Graham S Magic Formula Explained

Margin Of Safety Ratio Definition Explanation Formula And Examples Accounting For Management

Posting Komentar untuk "How To Figure Out Margin Of Safety"